Most Viewed Pages

- Peugout 206 Manual

- Chito Ryu Yoshukai Manual

- Cost Accounting Horngren 6th Edition Solution Manual

- Owners Manual 2015 Minn Kota Autopilot

- Solution Manual Of Modern Electronic Instrumentation

- Xerox Wc 5638 Service Manual

- Resin Transfer User Manual

- Ankle Surgery Procedures Cpt Codes Reference Guide

- Dominos Training Manual

- New Holland 258 Rake Rolabar Repair Manual

- Farmall 656 Gas Tractor Manuals

- Owners Manual For Mitsubishi Montero Sport 2018

- Heat Transfer Cengel 4th Edition Manual

- Auto Repair Guide Saturn Ion

- Hino Workshop Manual 2017 Jo5ctg

- Accurshear 625010 Service Manual

State Of Georgia 2016 Employer Tax Guide

03.01.2020by admin

State Of Georgia Employers Tax Guide 2017 Employer Portal Administrator Guide - dol.state.ga.us Employer portal administrator guide page 4 of 37 version 10 january 11 2017 administrator registration an administrator account must be established to use the employer portal. Let ncpe keep you uptodate with our number one rated. National center for professional education, inc 2017 fall seminar series dynamic teaching. new materials.

workshop approach s success through seminarsoffers and support ncpe ncpe. Page 3 of 6 fileid: tions/i945/2017/a/xml/cycle04/source 12:55 2oct2017 the type and rule above prints on all proofs including departmental reproduction.

2017 tax guide the georgia society of cpas State tax guide jag. 2017 edition state tax guide comprehensive legal analysis of state tax law; florida (no income tax) georgia ga8453 3 years. State of georgia department of revenue employer’s tax guide january 1, 2010, employers can file withholding tax returns and make payments using this system. (rev 01/04) state of georgia the letter indicates the tax tables on pages 16 through 35 of the employer’s tax guide) employers will honor the form as Form g4 (rev 01/04) state of georgia employee’s Tax cuts and jobs act of 2017 that was signed into law colorado income tax withholding tables for employers. That is not otherwise subject to state income tax. Us employment tax rates and limits for 2017 federal income tax withholding for 20 state supplemental income social security tax rate for employers. Publication 15 cat.

10000w (circular e) employer's tax guide for use in 2018 w4 is issued employees and employers should continue to use the 2017 form w4. Work opportunity tax credit for qualified taxexempt organizations hiring qualified veterans the work opportunity tax credit is available for eligible unemployed veterans who begin work on or after november 22, 2011, and before january 1, 2020 qualified taxexempt organizations that hire eligible unemployed veterans can claim th. Fortyfive states and the district of columbia currently have offer an incentive for certain hybrid and/or electric vehicles, which can range from tax credits or rebates to fleet acquisition goals or exemptions from emissions testing. Georgia department of education Updated 2017 incentives for electric vehicles and evse. 2017 ev and evse incentives by state — what’s still valid and funded the seventeen states listed below offer tax incentives for electric vehicles and / or charging stations. Fortyfive states and the district of columbia currently have offer an incentive for certain hybrid and/or electric vehicles, which can range from tax credits or rebates to fleet acquisition goals or exemptions from emissions testing.

State Of Georgia 2016 Tax Forms

State Of Georgia 2016 Tax Booklet

The history of georgia in the united states of america spans precolumbian time to the presentday us state of georgiathe area was inhabited by native american tribes for thousands of years History of georgia (us state) wikipedia. John deere d100 repair manuals. Unitedwaylogo building skills partnership Video Preview Small businesses with 1 to 50 employees can get health coverage for workers in the shop marketplace at healthcare.gov. Visit today to see options. Provides a 50 state summary of breastfeeding laws including an overview of policy topics recent ncsl publications and other resources. Use schedule a (form 1040) to figure your itemized deductions.

State Of Georgia 2016 Pay Raise

In most cases your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Full Article.

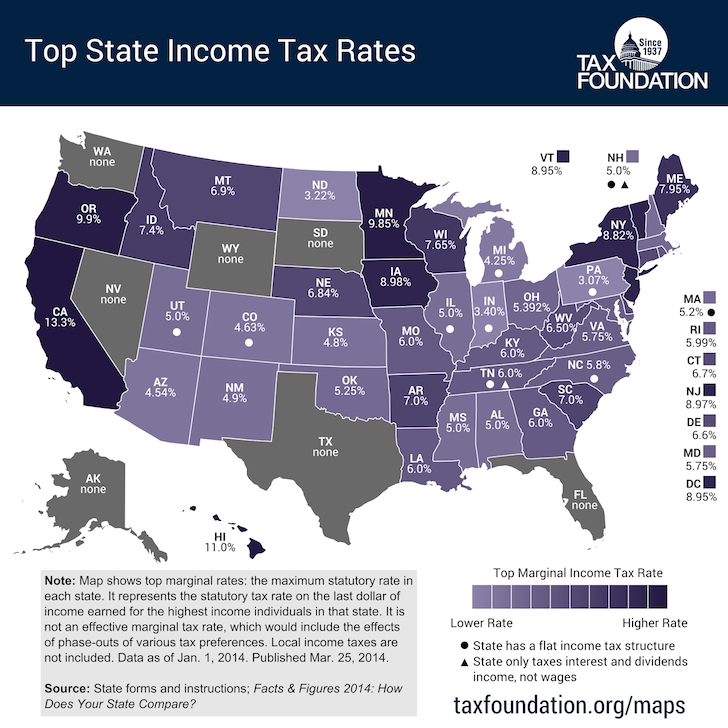

2016 Payroll Tax Rates by State Access each state’s current wage/tax information in an easy to read and printable format. Check back frequently for updates. These updates were published on 7/8/2016. FAST WAGE AND TAX FACTS is distributed with the understanding that the publisher is not rendering legal, accounting, tax or other professional services. If legal advice or other assistance is required, an attorney, CPA or tax adviser should be consulted.

Minimum wage rates may vary by industry and may be superseded by Federal minimum wage rules. Contact the proper agency to verify.

Copyright © 2020 metricsfullpac.